Write a short note on Public Goods.

Public goods are the goods that are neither executable nor rivalrous. These are also referred to as Collective Consumption goods. They are also one of the cause of market failure. One standary example of public goods is national defence services. These defence services give protection to all the citizens of a nation equally, irrespective of the number of the citizens in the economy and whether or not a particular individual has paid taxes to the government to support this. Other examples are the police force, law and order services, street lighting, provision of public park and infrastructure.

All these are public goods and equally available to all of us for collective consumption. Some of the people who do not pay taxes, can’t be denied access to them. So they are non-executable . Therefore, private firms will not provide them. The obvious solutions in these cases is for the government to provide them using its tax collection and making them available equally for the masses irrespective of their size and status.

On the other hand, we have externalities which also cause market failure. By externalities we mean certain costs or benefits of a transaction that are incurred or received by other members of the society but not taken into account by the parties to the transaction. They are also called the neighborhood effects and sometimes third party effects because they affect the parties other than the primary participants (the buyer and the seller) in the transaction.

The Externalities may be beneficial (positive) or harmful (negative). A harmful externality occurs when one factory pollutes harmful smoke incurring a cost on the part of other people in the society. A beneficial externality may be in the form of improvement of road in terms of smoothing and lightening giving benefits to other people.

These externalitises cause a divergence between the private benefits and costs of an economic activity and the social benefits and costs. Thats why the main problem of market failure arises due to them. Here private costs mean the costs that are incurred by the primary participants involved in a transaction. These private costs are borne by the firms when a good in produced. But social costs are the costs incurred by the whole society.

Social costs = Private costs + any costs borne by the third parties. Similarly we define private benefits as the benefits received by the primary participants directly involved in the activity and social benefits are the benefits to the whole society. i.e. Social benefits= Private benefits + any benefits to the third parties. Society’s resources are allocated in. an optimal manner when social marginal cost (SMC) equals the social marginal benefits (SMB). Since under perfect competition private marginal cost is equated to the private marginal benefit (Which is the price of the product), therefore, the free markets will not produce social optimality as there are discrepancies between private and social costs and private and social benefits.

Public goods are the goods used for collective consumption by everyone. They are non-rivalrous and non-excludable. A standard example is the defence services and law and order services provided by the government. Thereby the government provide safety to all the national/citizens equally irrespective their class, size of income or their position. It simply does not pay attention to the fact whether a certain section has paid taxes to support this large defence expenditure of the state or not.

Since all the people in the society are equally eligible to use public goods and use by one person cannot prevent others from using it, obviously private firms will not provide them. Therefore, the Only solution is the provision of these public goods by the government out of its tax collections. Other examples are Public Parks, Roads, Street lighting etc.

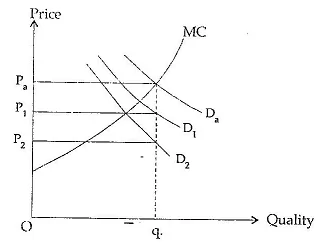

A public good should generally be provided when the government estimates that the valuation of the benefits of services to the community exceeds its cost, so that there is a net gain on its production. Consider the following diagram to understand the optimal quantity supplied by the government in case of public good say a Public Park.

In this case we assume that the society is composed of just two individuals 1 and 2, with a particular demand for public park.

D1 → demand curve of individual 1.

D2 → demand curve of individual 2 and

Da → aggregate demand curve which is

obtained by taking the vertical summation of D1 and D2. Now given these demand curves, the individual I wants to pay P1 for the quantity q. while individual 2 would pay P2 for the same quantity. Here q is the optimal quantity of the good which is determined by the intersection of MC curve with the aggregate demand curve. The two individuals would combined be willing to pay Pa which is the sum of P1 and P2 for the optimal quantity q.