What do you mean by redemption of debentures? Enumerate and explain briefly the various methods of redemption of debentures.

Meaning of Redemption of Debentures:

Redemption of debentures is a process of repayment of loan taken by issue of debentures. Generally debentures are issued with the notice that they may be redeemed at the option of the company within a specified period and at a specified price. The terms of redemption of debentures are clearly mentioned in the debentures certificate.

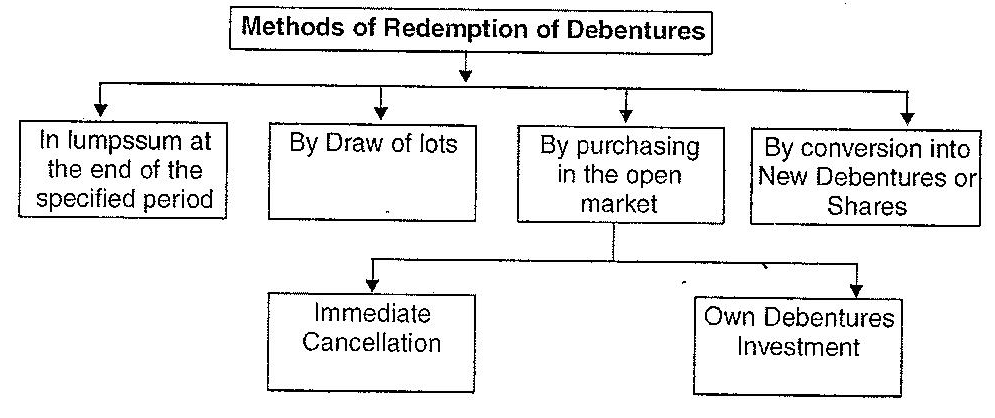

Methods of Redemption’s of Debentures

The debentures can be redeemed in one of the following four ways :

- In lumpsum at the end of the stipulated period.

- By draw of lots,

- By purchasing in the open market.

- By conversion into new debentures or shares.

In lumpsum at the end of a specified period : In this case, all debentures are redeemed at a time at the end of a specified period.

As the time of the redemption is known to the company in advance, it can make arrangements to provide sufficient funds for the redemption for redemption the best way is to set aside a part of the divisible profits and invest the same in readily marketable securities together with interest earned on such securities’ every year from the year of issue of debentures so that the required sum is available by selling the investments to repay the debenture holders on the date of redemption. This method is known as Sinking Fund Method.

Another method for investing the funds outside the business is Insurance Policy Method.

By draw of lots: Under this method, the payment of specified portion of debentures debt is made in installments at specified intervals/ dates.

Redemption by Purchase in the Open Market : A company may purchase its own debentures from the stock market either— For immediate cancellation, or As an investment. Generally, the company is interested to purchase its own debentures for redemption when the interest rate on debentures is considerably higher than the current market interest rate.

By Conversion into New Debentures or Shares: Debentures can be redeemed by conversion into shares or new debentures. A convertible debenture gives the holder the option to convert it into shares at a later date and also at a fixed price.When the debentures are converted into shares, the fixed interest charges of the company are to that extent reduced.