Describe the Ricardian Theory of Trade.

According to Ricardian theory of trade, comparative advantage determines the pattern of trade. Ricardo asserted that even if a nation does not posses absolute advantage, there are chances of gains through trade among the nations on the basis of comparative advantage. A country, in comparison to producing all the goods, it can produce and not trading, is better off by

- Producing more of the goods which it can produce relatively cheaply and exporting part of them, and

- Producing less, possibly none, of the goods which it cannot produce relatively cheaply compared to other nations and importing them.

Thus Ricardian theory is based on differences in technology across nations. A nation is said to have comparative advantage in a good if it can produce it relatively more efficiently or relatively less inefficiently compared to the other nation.

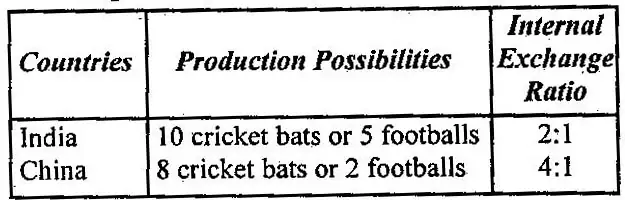

Let us take an example. There are two countries in world, India and China. Each can produce two goods, say cricket bats and footballs. Perfect competition prevails in the market for each good and each country is endowed with a given supply of labor. Suppose India is endowed with 100 units of labor and China with 120 units of labor. Producing one cricket bat required 10 units or labor in India and 15 units of labor in China. While producing one football requires 20 units of labor in India and 60 units of labor in China. Following table shows the production possibilities:

According to above table India has absolute advantage in producing both goods cricket bats and footballs and China in none. But India has comparative advantage in producing footballs and China has comparative advantage in producing cricket bats. It is so because labor is relatively more productive or efficient in the football sector.

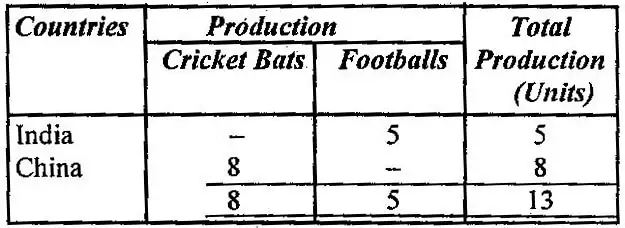

Although China is less efficient in producing both goods, it is relatively less so in producing cricket bats. Now India will specialize in footballs and export the footballs and import cricket bats from China. While China will specialize in cricket bats and export cricket bats and import footballs. By this, both countries will gain. Following will be the production in two countries with international trade:

The application of comparative cost advantages theory shown as under:

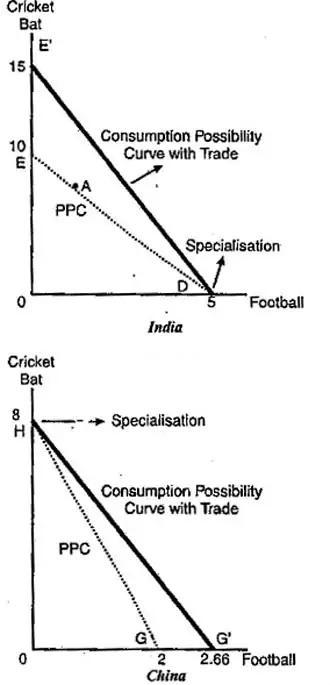

In the above figure, since India produces at ‘D’, one consumption possibility for India is the point ‘D’ itself. But there are other possibilities also. For instance, India can export one football in exchange for 3 cricket bats or 2 footballs in exchange of 6 cricket bats and so on.

These possibilities give a new curve ‘DE’. This situation is surely a better preposition for India than no trade, which offers the consumption possibilities along the PPC that lies to the left or inside the curve ‘DE’. ‘DE’ guarantees more consumption of each good. Hence, free trade must be prepared to no trade. Similarly, China’s consumption possibility curve is now ‘GH’, which lies outside China’s PPC. Thus China also benefits from free trade.

The Ricardian Theory of comparative advantage is based on a number, of assumptions, the most important ones are following:

- Production technologies in both the trading countries exhibit constant returns to scale.

- There is fixed supply of the factors of production.

- Factors of production can be easily and cost-lessly moved from one sector to the other as the country specializes through trade.

- The underlying market structure driving production is based on perfect competition.

- There is no technological innovation and there are no technological spillovers.

- There is full employment in all the countries before and after trade.

- There are no restrictions or barriers to trade between countries. It means there are no quotas, exchange controls, taxes etc. on the movement of goods.

The consumption advantage theory is criticized on following basis:

Comparative advantage theory shows one-sided approach i.e. supply side approach of the trade.

Most of the assumptions of this theory are extremes and far away from reality. It may be discussed as under:

- Production is not always subject to constant return to scale. Actual cost conditions may vary from increasing returns to diminishing return to scale.

- The assumption of no transport cost is unrealistic. The transport cost may offset the comparative advantage a nation enjoys and invalidate the theory.

- The assumption of full employment is unrealistic. Nearly all countries produce output at less than full employment level.

- The assumption of perfect competition is far from perfect. Presence of trade unions, minimum wage laws, quotas etc. come in the way of free pricing of factors of production. Even in product market, monopolistic competition and oligopoly are more realistic situations.

- The assumption of free trade, between countries is far from reality. There are all sorts of man made barriers like custom duties, exchange restrictions, quotas etc. which prevent free trade.

In-spite of above criticisms, classical theory offers a sound principle of trade. It is the classical theory, which asserted that a country benefits from international trade by specializing and exporting the products that it has comparative advantage in. This is true when a country is more efficient in producing all goods in an absolute sense.