Define a Bill of Exchange. Discuss in brief essential characteristics of a Bill of Exchange.

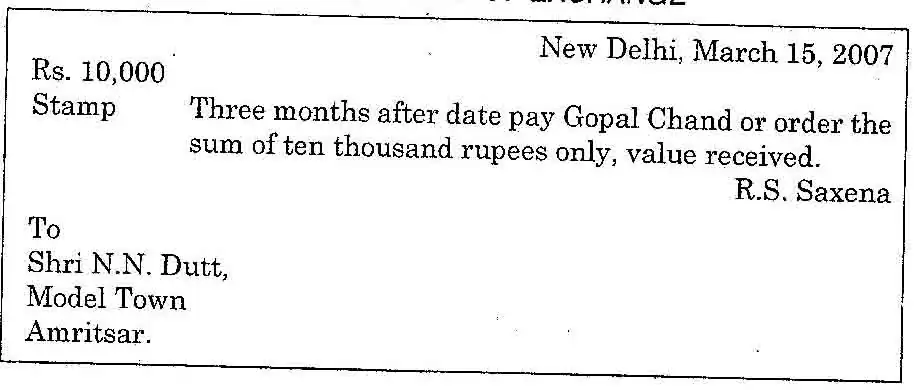

Section 5 of the Negotiable Instruments Act defines a bill of exchange as ‘an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument. The person who makes a bill of exchange is the ‘drawer’, the person who is ordered to pay is the ‘drawee’ or acceptor and the person to whom the amount is payable is the ‘payee’.

Essential Characteristics of a Bill of Exchange : To be a valid Bill of Exchange an instrument must comply with the requirements of the definition give in Section 5, which are as follows :

- It must be in writing, Oral or verbal order is not a bill.

- It must contain an express order to pay, A Mere request or a reminder to pay money is not a bill of exchange.

- The order to pay should be unconditional. A bill cannot be drawn so as to be payable conditionally, The drawer’s order to the drawee must be unconditional and should not make the payment of the bill dependent on a contingency.

- It must be signed by the drawer. Without signature the instrument remains inchoate and ineffectual. No action can be maintained on a bill against the acceptor if it has not been signed by the drawer.

- The drawee must be certain. The drawee must be named this is important because the payee must know the person to whom he should present the instrument for acceptance and payment.

- The sum payable must be certain.

- The instrument must contain an order to pay money and money only.

- The payee must be certain. The bill must state with certainty the person to whom the payment is to be made so as to enable the drawee to know to whom he may properly pay it, to discharge him from all further liability.